A Financial First Aid box is very, very important in case of emergencies or when you are not accessible to your family. Have you put that in place – A financial emergency kit? Trust me… It is VERY Important! We are all so busy in our lives that pausing and thinking is not an option. […]

Why there is no such thing as “Right Time for Investing”?

We are always worried about when is the right time to invest and when is the right time to buy and sell. It can actually be your biggest Investment mistake, read on why. As an investor we often come across a dilemma about what is the right time to invest in a certain type of […]

5 ways to save taxes that are NOT Insurance

Traditionally tax saving is all about LIC and insurance, but there are ways you can save tax without insurance, and earn good returns. Here are some tax-saving options that are not insurance based. I am being asked by friends and those who are regulars at stepupmoney “What are good tax-saving options this year?” And before […]

Tax Saving Fixed Deposits: What are they, How they work?

We all love bank FDs, but fret over it not being able to save taxes. Actually Tax Savings FDs are available that do exactly that, save some taxes. Let’s have a look at this product. It is the beginning of that time of the year when you are looking for options to save tax and […]

8 simple steps How to transfer your PPF account from Post Office to any Bank

A lot of you may have a PPF account in a Post Office and would want to transfer it to a Bank. Here’s how to transfer your PPF from Post Office to Bank and what possible problems you could face in doing so. Continuing our focus on PPF or Public Provident Fund, which is sort […]

Grow your money in PPF even after your PPF matures

What happens to your PPF account on maturity? Can you contribute further? PPF has different options for you to choose on maturity. Get the answers here. Continuing our effort to bring some of the simple yet effective investment options out there, which are safe and still give good returns on investments we continue our focus […]

PPF: Simple and Best Tax Savings Product with Guaranteed Returns

All you need to know about PPF, a tax saving, guaranteed returns product. PPF suits almost everyone and is equally easy to invest and understand. Read on. We at stepupmoney, constantly strive to give the best and simplified insights into the complex world of personal finance. We understand that for most of us Indian investors, […]

Why avoiding Bad Investments is important than focussing on Good Investments?

Sometimes just avoiding a bad investment better than making good investment. If you don’t understand a great investment, better stay away rather than losing money due to lack of knowledge. So often I come across people always curious about what is the next big investment opportunity and wanting to invest in it, even when they […]

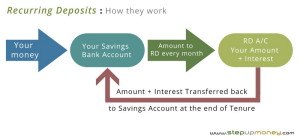

Recurring Deposits: All you need to know

Recurring Deposit is a fantastic financial tool which can be used to meet a lot of your life’s goals without any risks, with guaranteed returns. Here is this product explained. One of the most simple and straight forward investment tools is Recurring Deposits or RD. It is wonderful in a way that it is not […]

Why compulsory investments are best for your Financial Life

Compulsory Investment can be best for your financial life and at times the best way to get your finances in order to get into a savings habit. Here’s why and how. If you have been delaying that savings habit or still shrug and say “well I tried, it just does not happen….” or you feel […]