Women often find that personal finance is something for the men to think of and let them do the math. However, Women should be more involved in personal finance and they can be even better than men at it. It is not Women’s Day that I am writing for women. Instead it is the start […]

The ‘Loan’ly Life – We live and breathe EMI

Buying stuff on loan has made our life so easy that everything is available on EMI. But EMI is a great tool as well as terminal disease that eats your life. Here’s why As a continuation from our previous post on Affordability and the Myths about it, we focus on Loans and EMI and what […]

Oh! I can Afford that… The Affordability Myth

Thinking you can afford certain things and actually being able to afford them are two different things. Be it a car, a house, latest smartphone or even those clothes you bought off sale; can you really afford it? Things are getting easier if you are planning to make a purchase these days isn’t? You don’t […]

Why we never end up saving ‘Enough’

So often we realize that no matter what we do, we are never able to save ‘enough’. Why is it so? Why we can’t save enough? All of us work hard for a good life. Healthy life that can take care of medicals, bills, kids, their education, a car; later on in life a house […]

7 questions to check, Is your financial life secure?

Is your financial life secured because you have a well paying job for now or just because you can pay your bills on time you are well off? Think again, these 7 questions can be an eye-opener. A lot of people often think that because they are relatively younger and earn a good amount of […]

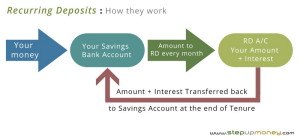

Recurring Deposits: All you need to know

Recurring Deposit is a fantastic financial tool which can be used to meet a lot of your life’s goals without any risks, with guaranteed returns. Here is this product explained. One of the most simple and straight forward investment tools is Recurring Deposits or RD. It is wonderful in a way that it is not […]

Why compulsory investments are best for your Financial Life

Compulsory Investment can be best for your financial life and at times the best way to get your finances in order to get into a savings habit. Here’s why and how. If you have been delaying that savings habit or still shrug and say “well I tried, it just does not happen….” or you feel […]

8 Reasons Why starting a Business may not suit you?

With so many people taking the plunge towards starting their own business, it is a good time to ask yourself; are you suitable for business? Or will starting a business suit you? It may not for the following reasons. Just walk around and meet a few friends you haven’t been in touch with for a […]

Financial Crisis: 8 things to learn from it

Financial Crisis can leave you in shambles, but it also teaches a lot of important lessons for life. Sometimes Financial Crisis can actually be good for you. Here’s why. A Financial Crisis can make or break your future financial life and for all you know; it can be the best thing to have happened to […]

Manage your own Money: Why and How?

We work hard to earn money to better our lives every single day. But how do we treat this hard-earned money? Do we manage it ourselves? I don’t think so. We all should manage our own money. Here’s why. ‘Manage your own money‘ – A good topic that was highlighted by one of our readers […]