In today’s day and age, there are lot of unconventional jobs and with that there are more number of people with irregular flow of income. This irregular income can affect their finances too. There was a time when having a job meant getting regular income, having periodic appraisals, and planning for a retirement through […]

Why is Short Term Investment not advisable?

Short Term Investments are good to park your surplus funds to earn a bit more from them. However the practice of only investing for the short term or having a short outlook for investments is bad for your money. People are not patient these days. We want everything fast, thanks to that craving of the […]

Why you Spend more, when you Actually Don’t find what you want to shop for?

So often we go shopping and don’t find the thing we are looking for. Still, we end up spending more! Yes, we do. Here’s why this happens to almost all of us. Shopping in any form, be it out of necessity or just in the name of therapy, is often loved by people of all […]

Oh! I can Afford that… The Affordability Myth

Thinking you can afford certain things and actually being able to afford them are two different things. Be it a car, a house, latest smartphone or even those clothes you bought off sale; can you really afford it? Things are getting easier if you are planning to make a purchase these days isn’t? You don’t […]

Why we never end up saving ‘Enough’

So often we realize that no matter what we do, we are never able to save ‘enough’. Why is it so? Why we can’t save enough? All of us work hard for a good life. Healthy life that can take care of medicals, bills, kids, their education, a car; later on in life a house […]

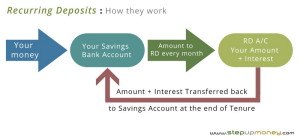

Recurring Deposits: All you need to know

Recurring Deposit is a fantastic financial tool which can be used to meet a lot of your life’s goals without any risks, with guaranteed returns. Here is this product explained. One of the most simple and straight forward investment tools is Recurring Deposits or RD. It is wonderful in a way that it is not […]

Why compulsory investments are best for your Financial Life

Compulsory Investment can be best for your financial life and at times the best way to get your finances in order to get into a savings habit. Here’s why and how. If you have been delaying that savings habit or still shrug and say “well I tried, it just does not happen….” or you feel […]