It is the start of 2014 and we all have many things to do, resolutions to make. Among those many things, there are some ‘Money’ things to be done in 2014 as well. Read on. It’s New Year!!! We are all positive and full of hope that the good things of 2013 carry on and […]

Why avoiding Bad Investments is important than focussing on Good Investments?

Sometimes just avoiding a bad investment better than making good investment. If you don’t understand a great investment, better stay away rather than losing money due to lack of knowledge. So often I come across people always curious about what is the next big investment opportunity and wanting to invest in it, even when they […]

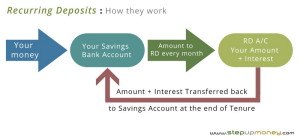

Recurring Deposits: All you need to know

Recurring Deposit is a fantastic financial tool which can be used to meet a lot of your life’s goals without any risks, with guaranteed returns. Here is this product explained. One of the most simple and straight forward investment tools is Recurring Deposits or RD. It is wonderful in a way that it is not […]

Investment Tips for Beginners: Part 4

Now that you have a brief overview and knowledge of the type of investment and savings option you have, let’s get started with things you can do to get your investment ball rolling with minimized risks. As this post is all about helping beginners with investments, I have listed down more traditional and tried and […]