Job-loss often brings despair and sudden shock and we often scamper for the next possible job that is available. However, taking a break after a job-loss can be good for you; here’s why. Job-loss: these words send a chill down the spine for many but have you tried to think a bit differently? I mean […]

Why buying Used or Second Hand Products makes sense

Buying used or second hand things, in some cases is actually good and makes perfect financial sense. Here are some of the things you can consider buying second hand or used. We love purchasing new stuff, flaunting it and feeling proud to have achieved something we wanted. It could be a new smartphone, new car […]

Here’s Why your Home could be your Biggest Liability

Buying your own home is a biggest achievement for many. But is your home really your biggest asset or actually your biggest liability? I think it is the latter. Being successful in your career, building assets, reaching financial stability, buying a home and settling down are the most common goals most of us have. For […]

Internet Banking Fraud: SIM Swap; Can you be a Victim?

Phishing is a well known online banking fraud, however perpetrators also have another weapon SIM-Swap to steal your hard earned money via internet banking fraud. Let’s Find out what it is. Phishing attacks or attempts are pretty well-known, wherein you get emails from address that are similar to your bank, and are asked to click […]

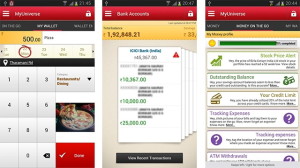

7 Apps that help you Manage Money easily

If you cannot figure out where your money goes at month end, or cannot save much, these smartphone apps can manage your money easily and help you keep track of your finances effortlessly. Technology has indeed changed our lives and made managing things a lot easier, especially the advent of smartphones, and the fact that […]

How technology helps to Make and Manage Money

Technology is growing rapidly and with it everything is connected and provides a lot of options and convenience in almost every aspect of our lives, including Finances and money in general. Today everything is at our fingertips, either in our smartphones, tablets or at a mouse click. Thanks to Google and Apple who kind of […]

How to open a Minor Account for Children in India

Opening a bank account for a minor is a great idea and can go a long way to teach them the savings habit as well as a good way to plan for their future. Here’s how to open a minor account in India. Opening a bank account for kids is a great way to teach […]

Why you shouldn’t be ashamed of doing a Home Based Business or Work From Home job

If you work from home or are having a home based business; it can be a great thing and if anyone discouraged you, they are WRONG, and here’s why. In today’s scenario there are a lot of unconventional fields and a career options. Also with the ever increasing penetration of the internet, the office space […]

What Budget 2014 means for you and I – the Common Man?

There are lot of proposed initiatives in the current budget and while most of it will take time to show results; for you and I, the common man what it means? Let’s have a look. Budgets are often projections, initiatives, allocations, and an intention to implement them over the period of that financial year or […]

What is your True Wealth?

Real wealth is not necessarily the worth of money you have or the things your money can buy. It is actually something that most of us can have and experience and why you should want to earn it more. Wealth is often called a ‘state of mind’ as in it depends on a person as […]

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 9

- Next Page »