Phishing is a well known online banking fraud, however perpetrators also have another weapon SIM-Swap to steal your hard earned money via internet banking fraud. Let’s Find out what it is. Phishing attacks or attempts are pretty well-known, wherein you get emails from address that are similar to your bank, and are asked to click […]

Top Car insurance Companies in India

With the market flooded with so many insurance companies, how do you choose which the best car insurance in India? Car insurance is an important aspect of your car maintenance package. Third party insurance is mandatory by law but it is the comprehensive cover or comprehensive Car insurance in India is where the decision becomes […]

7 Things to Remember before buying Car Insurance

Your priced possession needs a good insurance and there are lot of attractive options. However you should remember a few things before buying car insurance in India. With so many new vehicles hitting the road each day and bumper to bumper traffic to watch out for as soon as you start your daily commute; not […]

Smartphone Insurance: Do you really need it?

With so many smartphones seen around, is it wise to insure a device that is an integral part of your daily life? Do you need smartphone insurance? Maybe you do, let’s find out. There are smartphones everywhere and almost everyone around seems to flaunt one from various brands. The things is that while all the […]

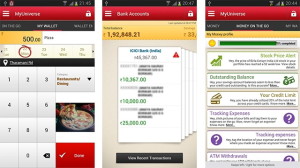

7 Apps that help you Manage Money easily

If you cannot figure out where your money goes at month end, or cannot save much, these smartphone apps can manage your money easily and help you keep track of your finances effortlessly. Technology has indeed changed our lives and made managing things a lot easier, especially the advent of smartphones, and the fact that […]

How technology helps to Make and Manage Money

Technology is growing rapidly and with it everything is connected and provides a lot of options and convenience in almost every aspect of our lives, including Finances and money in general. Today everything is at our fingertips, either in our smartphones, tablets or at a mouse click. Thanks to Google and Apple who kind of […]

How to open a Minor Account for Children in India

Opening a bank account for a minor is a great idea and can go a long way to teach them the savings habit as well as a good way to plan for their future. Here’s how to open a minor account in India. Opening a bank account for kids is a great way to teach […]

Why you shouldn’t be ashamed of doing a Home Based Business or Work From Home job

If you work from home or are having a home based business; it can be a great thing and if anyone discouraged you, they are WRONG, and here’s why. In today’s scenario there are a lot of unconventional fields and a career options. Also with the ever increasing penetration of the internet, the office space […]

What Budget 2014 means for you and I – the Common Man?

There are lot of proposed initiatives in the current budget and while most of it will take time to show results; for you and I, the common man what it means? Let’s have a look. Budgets are often projections, initiatives, allocations, and an intention to implement them over the period of that financial year or […]

How an Irregular income can affect your finances badly

In today’s day and age, there are lot of unconventional jobs and with that there are more number of people with irregular flow of income. This irregular income can affect their finances too. There was a time when having a job meant getting regular income, having periodic appraisals, and planning for a retirement through […]

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 14

- Next Page »