: Owning a house is a Huge deal for so many of us, that it becomes the only thing left in our lives. Is this thought process really healthy or is it wrong? Let us find out. Home or your humble Abode or your dream home or whatever you call it; buying a Home is […]

Here’s Why your Home could be your Biggest Liability

Buying your own home is a biggest achievement for many. But is your home really your biggest asset or actually your biggest liability? I think it is the latter. Being successful in your career, building assets, reaching financial stability, buying a home and settling down are the most common goals most of us have. For […]

7 Things to remember before taking ANY KIND OF LOAN

Taking a loan is an important decision even if it is a small amount. There are certain things you should always remember before even considering any loan. Loans come in all sizes, if that is an appropriate term. Anyway, home loans are a BIG commitment while car loans are relatively lesser burden. Credit card payments […]

A loan without EMI: Reverse Mortgage

Reverse Mortgage is one such loan, wherein the borrower does not have to pay the EMIS but instead receives tax free income from the lender. Find out more about this financial product and how it works. Loans are typically products that would make you end up with a burden of EMIs for a long period […]

9 steps to Hunt for Property the smart way

Finding a property in India can be tricky and tedious at times, but not if you do it the right way. Here are ways to hunt for a rental or buy property in India the smart way. Property in India is always a hot topic among the home seekers. The sky-rocketing prices in the metros, […]

What is your employment type? Understand the Nature of your Employment.

Do you really know the nature of your employment? Are you an Employee of the company you work for or are you a contracted professional, who is on a retainer ship contract? You get Form 16 or Form 16A? So you have a great job, with great pay and you have got the world at […]

Factors affecting your Home Loan eligibility

Apart from your monthly income a lot of factors affect your home loan eligibility. Banks and NBFC consider a lot of aspects before giving you a sanction letter for your home loan application in India. With banks and Non Banking Financial Companies making conscious efforts to rope in a wide and diversified customer base […]

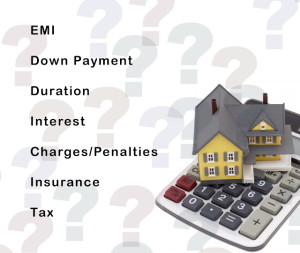

7 Things to remember before getting Home Loans in India

A home buying decision depends to a great extent on the amount of Home Loan you can avail. But before you decide on borrowing, do keep these important things before applying home loans in India, in mind. Not saying that the real estate is affordable, if anything for a majority it is a dream […]

Complete Guide to getting Home Loans in India

Getting home loan plays a big part in fulfilling a dream, and while things are much smoother these days, some points should be kept in mind while applying for home loans in India. Applying for Home Loans in India has become much simpler and quick. However you should keep certain things in mind before […]