*Update: 7th March, 2015

Writing a cheque is probably the easiest thing to do right? Well, maybe. But there some simple things we overlook while writing out a cheque to someone that can easily be misused. This post will discuss the ‘hows’ and’ whats’.

You all may think that what’s a big deal in writing a cheque? We write it so many times to pay bills, make payments etc. But there are times when people make the most obvious and sometimes careless mistakes while writing a cheque that can easily result in frauds or cheques being misused or dishonored. Let us see what the correct way to write a cheque is and how to avoid mistakes while writing a cheque.

You can also find an informative post on Why a cheque bounces or gets dishonoured, over here

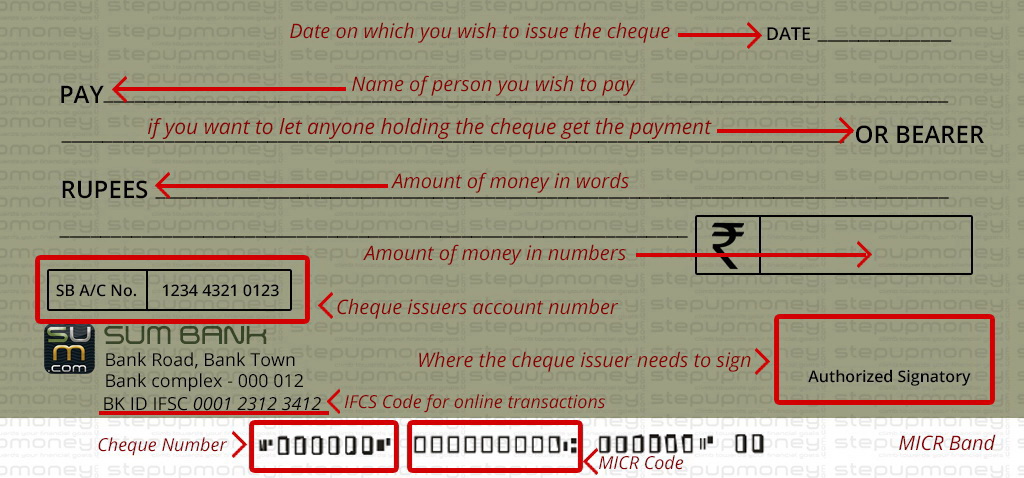

Understanding various parts of a Cheque:

What is an MICR code? Where is the Cheque Number located on a cheque? Is there an IFSC code on a cheque? If you have asked yourself these questions, then here are all the answers. It can be very basic but sometimes the most basic things are the ones which are most overlooked.

This image below is of a dummy cheque which covers everything you see on a cheque, it is pretty self explanatory.

Writing a Cheque the correct way?

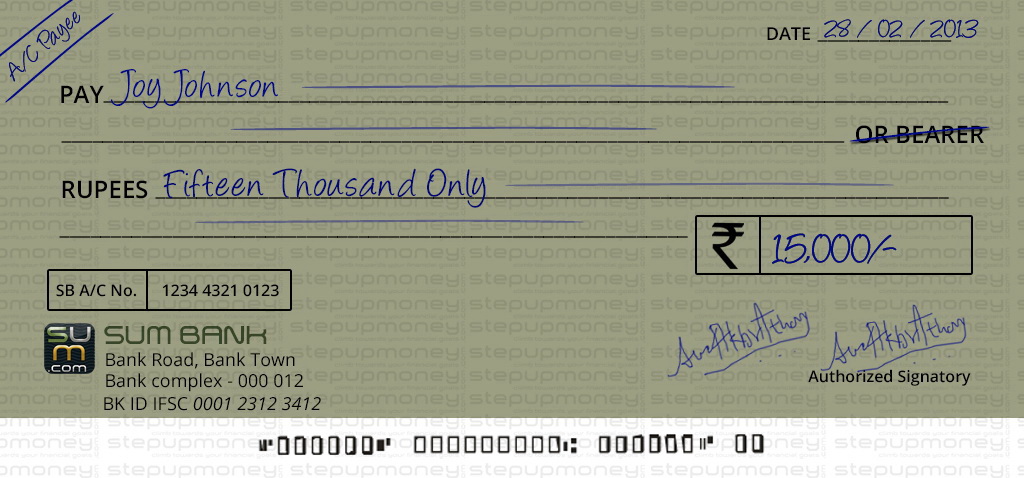

For understanding the ways to write a cheque correctly, we have a typical situation where you have to pay some fictional person Mr. Joy Johnson a sum of Rs. 15000 INR from your bank named SUM BANK, assuming the payment date to be 28th Feb 2013. So now let us get down to seeing how we can write all the details correctly.

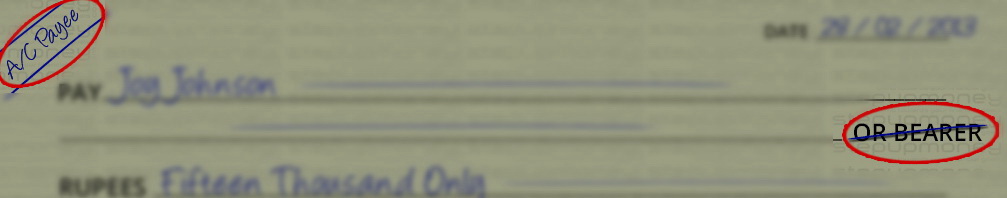

1. Cancel the words ‘OR BEARER’ and Add ‘A/C Payee’ to the Top Left corner of the cheque:

Cancelling the words ‘Or Bearer’ and adding ‘A/C Payee’ to the top as shown in the image will make sure that no one apart from the person in whose favour the cheque is drawn can get the money. If you do not cross the words ‘Or Bearer’, it can be treated as a Bearer cheque and any person holding the cheque can claim the money. Imagine if a cheque is lost, all this comes in to play.

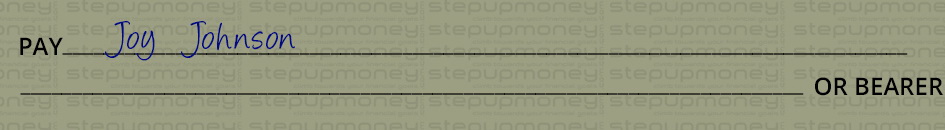

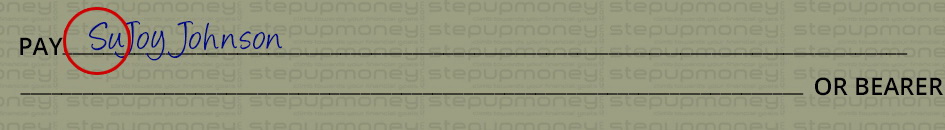

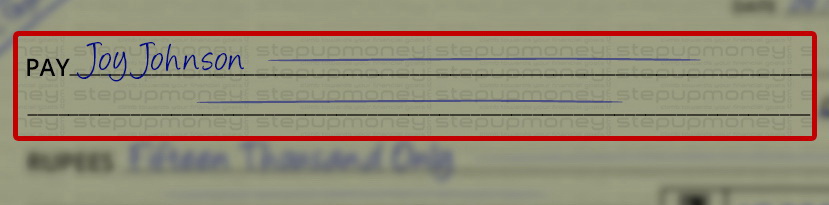

2. Do not leave any space before or in-between the Name of the Receiver. Do not leave blank space after the Name is written:

Do not leave space between the word PAY and the Name of the Receiver or in between the name and surname in this case (Joy Johnson). Doing this can give anyone a chance to add alphabets before or after the name (like in the images below) and claim the money.

Same can be done if you leave space after writing the name. (See image below).

Always strike out the space after writing the name and start as close as possible to the words ‘PAY’ and leave just bare minimum spacing in-between the names as shown in the image below.

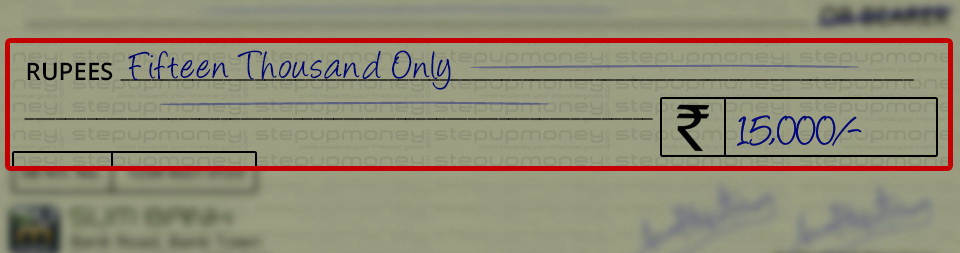

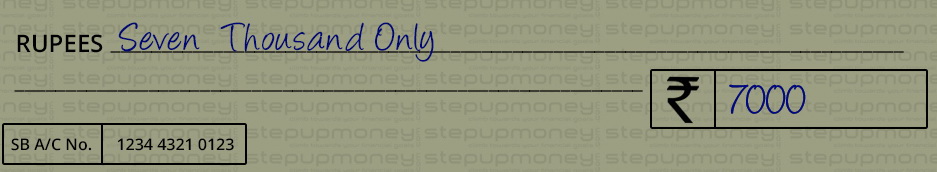

3. Always write ‘ONLY’ at the end of writing the Amount in Words in the ‘RUPEES’ column. Also put a /- in the ‘Rupees in Number” column. Do NOT leave Spaces Anywhere:

As shown in the image below, always write the words ‘ONLY’ after the amount in words. When writing in numbers, put a ‘slash’ as separation in case there are Paisa to be paid. In case there is no Paisa, just put a hyphen after slash like this ‘/-‘ Also, just like the Name; do not leave space before writing the amounts in words as well as numbers and strike out the empty space left.

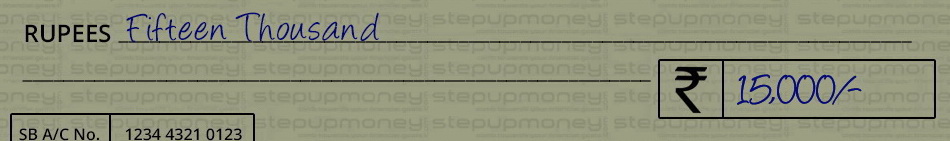

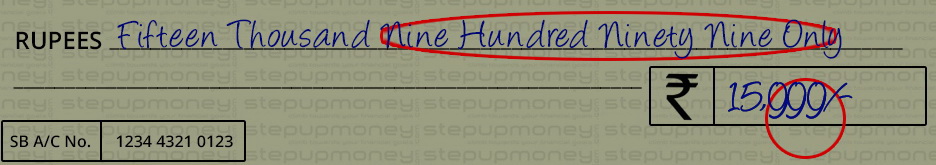

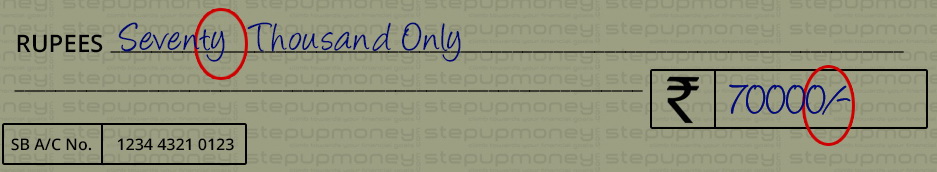

If you do not follow the above; amounts can be altered easily by the fraudster. In the image below you can see how easily certain amounts can be forged by people if the Cheque Issuer is careless.

In the example image above, Fifteen Thousand becomes ‘Fifteen Thousand Nine Hundred Ninety Nine only’ the fraudster can easily add a few strokes below ZEROs in 15,000 and get INR 999 extra.

Also in a scenario where you leave too much space between words on your cheques or do not add the ‘/-‘ sign after the amount in numbers it is very easy to commit fraud. Alphabets can be added and even numbers. See image below.

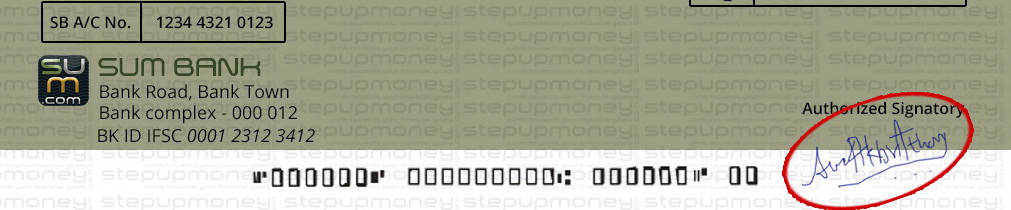

4. Do Not sign on the MICR Band:

As shown in the image above, signing in the MICR Band is WRONG and can get your cheque dishonoured. Always sign on the space provided above the Authorized Signatory text or The Name of the Account Holder as in the image below.

5. Don’t Forget the Date:

Writing a cheque without a date can enable anyone to put any date and encash the cheque at their will. This can be a problem if you do not have sufficient balance in your account right now and intended the cheque to be a post-dated cheque when that amount maybe available. The cheque will be dishonoured. Also a cheque without a date will not be passed by your bank and again will be dishonoured. Also a wrongly written date, like a wrong year or a month can often result in dishonour if the date is past 3 months.

6. Do not Overwrite:

Always remember to not overwrite, scribble or cancel anything and then rewrite on a cheque. If mistakes happen try to rectify without scribbling, and if not possible, cancel the existing cheque and write a new one carefully.

7. Keep the records of your cheques:

Always keep a record of the cheques you issue to people or cancel. Note down the cheque number and amount paid along with the name of the Payee and the Date of issue. Usually cheque book comes with a section for all this information at the back. Fill in the details and keep it handy to cross check any suspicious activity, future records, or possible fraud.

A properly written cheque can be found in this image below.

General Safety Measures for Writing a Cheque Correctly:

- Destroy all cancelled cheque unless they are used for any specific purpose like for submitting for ECS etc.

- Never Handover a cheque without entering all three: Date, Payee name, Amount of Cheque in words and Numbers.

- Sign clearly and if needed sign twice (as seen in the image above), to make sure the cheque is not bounced for a mistake in signature.

- Write the Credit Card Number, Connection Number, Mobile Number etc on the reverse of the cheque in case of payments being made towards bills for utilities.

- Do not staple, fold, disfigure, or stick the MICR Band.

Hope this post helped you all. If I have missed anything, feel free to leave your views in the Comments below.

Thanks Avinesh ! This is very helpfu

Sir, I would like to give an account payee cheque to a person in his Name.

Can I add his account number too for an accurate confirmation, that it can be encashed through his account only.

(There could be many people in that Same name ri?)

i would like to keep FD in sbi bank .but i have balance in syndicate bank so how to write cheque

Since 2010, No scribbling and counter signing is allowed on cheque. However, I am told that the same is allowed only for correcting the date. Pls reconfirm.

Hi Moiz,

Scribbling on cheque is not recommended. Also, while most banks do seem to be OK with the date change, where the issuer signs on it, it is advisable to get or issue a cheque which is completely free of any overwriting or scribbling.

I received a cheque in which amount in words is written as One Million one thousand is it correct.?

Hi Mohit,

One million should not be written on Indian cheques, dealing with Indian currency. Hundreds, Thousands, Laks / Lacs and Crore are the typical denominations followed and accepted for cheques.

give in the specimens pay in slip and specimens in chaqe print formet PDF plz sir

Good knowledge I got everything which I wanted to know

Thank you so much sir It’s. Very useful

Hi Champakala,

Glad you found it useful.

Thanks a lot ..it will help everyone…

if i cross the word “Bearer”, can the customer withdraw money in cash? i forgot to double cross the cheque and not mentioned “a/c payee” but i crossed the “bearer” word.

If you have crossed the word bearer, then the person can’t take cash.

Hi I’m from Canada but originally mother in law from Mahim Mumbai India ”

Is it better to write a cheque that says Rs.450,000 or is it better to write A cheque that says 4 laks 50000 Rs which is a little more complicated to figure out

You need to write it in both words and numbers – So in the words column you cannot use any numbers and in the numbers section no words. So you have to write it as Four Lakh Fifty Thousand Only – in words and 4,50,000/- in the numbers part. You can refer this same article above to find the screenshots of these sections in the cheque.

THANK YOU SIR IT WAS VERY HELP FULL TO ME.

Can I transfer money from my account in one bank to my account in another bank through cheque. If yes, how?

Thanks.

Aparna

Sir

Does a pan card is necessary to drop a cheque of more than 100000

Hi Anand,

No it is not necessary. If the bank feels, they may ask you for it. But generally you wouldn’t need it.

I have two questions

1. If I cross the cheque without writing the words ‘A/C Payee’ in between those lines then how does that give authority to another person I want, to withdraw the money?

2. If I want to make a bearer cheque then should I keep the space after PAY remain vacant or crossed out??

Waiting for your kind reply.

is it acceptable to write amount in words for example Rs. 12500/= in word “one two five zero zero”??? instead of twelve thousand five hundred.

Hi Rashmin,

No, it is not advisable since banks need the value and not the numbers on a cheque in words.

Hello Sir,

First of all thank you for all information.

My query is about the name we writing on cheque. In what manner we have to write it so that it will easily recognized by bank in which cheque will deposit?

Hi NIl,

In which bank the cheque will be deposited, depends on the receiver as to where he/she has an account and they deposit it to their respective banks. There is a slip attached with a cheque which has the details of account number and others to ensure the cheque lands up in the correct account. That is for the receiver to worry about.

All you have to do is simply write the name as told to you by the receiver.

Hello sir,

If I write 12345 in word like ” one two three four five ” on the cheque than it is acceptable? ???

In case case a cheque is issued of 120000.the money maķe it90200 by atration himself what the bank willdo

Hi Sunil,

It will have to be a very skillful effort to make 120000 look like 90200 in numbers as well as words. Most likely it will bounce as th cheque should have the same amount in Words in numbers, which in this case is highly unlikely to achieve.

Hello Sir

Can it be withdrawn by other person if there is written “SELF” in “pay to” column.

Hi Jhasa,

Self cheques are for the account holders only. Others cannot withdraw using that. For such a thing a Bearer cheque is required

Hi sir, appreciate your work in elaborately and patiently explaining about the different nuances of cheque related issues

My query is I have been issued an account payee cheque for me which contains dr as title before my name in the cheque …will this be ok … Like dr satish instead of satish as my account has just satish

Hi Satish,

Mostly it should be fine as if the bank has a doubt they might get in touch and ask for some ID proof which has the similar name. But by and large there may not be any major issue.

Thanks a lots . most useful to me guided.

sir can u tell me person can take cash from other bank by check although he is not having bank account…and that check is issued by another bank..

2-one more,that i have issued a check to person i had not wrote payee a/c in corner,is that check can be used for account of that person…he had accoint in other bank and same branch is not near.pls now what we can do???

hrllo sir…

1- i want to ask that without writing “payee a/c” in corner of cheque means bearer cheque. payee can use that check for his account from anothrr bank?

2-i gave the bearer check to person..but he is not having account in any bank…issuing bank s branch is not their in his city…he can take cash from another bank or not?if yes then how

3-if i gave self cheque to another person..bank can cash him..

4-if person want on spot cash from another bank rather than issuing bank…although he is having account then he can..?and also if he is not having account still he can take on spot cash by showing identity.

Hi Manpreet,

1. The person receiving the cheque can present it for clearance in any of the bank he has an account with the same name as mentioned on the cheque. Unless the cheque is drawn on a specific bank. A/C Payee means no one other than the person can use the cheque, it has nothing to do with the bank in which he presents the cheque.

2. He can take cash from either his own bank or from the bank he/she got the cheque from.

3. Self cheque is for the person themselves, no one else who is not the account holder, can use such a cheque.

4. NO

It was really helpful.But i have a doubt.will u verify it.

I wrote a check for Rs 500.But due to hurry I din write it in words or put /- at end.What if he adds 0’s at end.How to prove it is forged.

Can someone pls help me out.

Hi Kishore,

That is a bit of a problem. If you had written in in words, it would have been a safety barrier as even if he would have added a ‘0’ at the end, the written words would have not matched and the cheque would have bounced. HOwever, since that is not the case, you can ask your bank to stop the payment of that cheque to be on the safe side and issue a fresh cheque.

Hi Kishore,

Glad you like the post. Yes, you an share your doubts

Great Article.. thanks a lot for sharing…

Thanks a lot Bilal for the kind words of appreciation.

help me

how write this amount 2002.50 in cheque leaf

Hi Shaheena,

Simply write Two Thousand Two Rupees and Fifty Paise.

Hi Aniket, Thank you for this very helpful article.

I heard somewhere that while writing the amount in words, its acceptable to write – for e.g. for Rs. 7239 – as SEVEN TWO THREE NINE ONLY.

Is that true ?

Hi Kunal,

To the best of my knowledge, writing Rs 7239 or any amount for that matter as Seven Two Three Nine Only etc… is NOT allowed. You need to mention the amount as it is meant to be that is in this case – Seven Thousand Two Hundred Thirty Nine Only.

Hdfc bank clear a cheque if written like Rs.seven/two/three/nine/only. But majority banks don’t accept due to no awareness.

Hi Aniket, I have a Tax refund cheque from US Treasury which contains both my name and my wife name. I want to deposit that cheque in ICICI bank as I have the joint account in ICICI bank. The issue is, the last letter ‘a’ of my name Chandrakanth Gadwala is not printed on the cheque ( printed as Chandrakanth Gadwal) while my wife name is printed correctly. When I asked customer care of Tax Dept they said it is due to the system limitation(Max Length) and even if they re-issue it will print like that only. Will the bank process the cheque if I deposit this?

Hi Chandrakanth,

You can go ahead and deposit the cheque. It is a common issues in printed cheques, so it will pass. Don’t Worry.

I have received a cheque without a/c no. but followed by IFSC code and MICR code. Is the cheque valid? Its a cheque from a company to an individual.

Hi Pryanka,

Please ensure the cheque is CTS 2010 compliant and has the words CTS 2010 printed in the extreme left corner centre of the cheque vertically. If that is the case and the cheque is duly signed and your name and details are correct, the cheque will pass. No issues in that.

Sir,my uncle wants me to withdraw money from his account through cheque without his presence. So,what is the process to do this???what should be written on the cheque???

Hi Sonali,

It should be a bearer cheque with his signature that you can produce and withdraw money on his behalf.

If someone’s name is Imram Sheikh and he receives a cheque as Sheikh Imran. Can he deposit in bank and encash. Pls suggest in perspective of 2015 rules.

Hi Sankha,

If the name is registered with the bank in that manner then it should be fine. Also you will have to attach a slip with the cheque to ensure the account details are correct for that cheque to be cleared. Also do remember, these things are also dependent on the banks, some banks allow and pass the cheque and certain times if they feel something suspicious they may reject it.

I have misspelt the word “Ninety” as “Ninty” on the cheque, in the “Amount in Words” space. Will the cheque be accepted?

Hi Jayati,

If the amount is around some regular range of transactions you do then the banks will overlook that in most cases.

What is that regular range?

Hi Pooja,

Regular Range meaning, the usual amounts your do transactions for… like some might have routine transactions of say in a range of 20 to 50 thousand for example, then banks notice the trend and know that these type are the usual or regular kind of transactions. It varies from person to person. So if the banks see a cheque with slight mistake or with more than usual amount of transaction they might alert you on the same. It is a relative thing, and as I said will vary from account to account.

Sir,My Name is Suraj Kumar Prajapati but on the cheque it was written “Suraj Chedilal Prajapati”The middle is my fathers Name.its a Multi City Cheque of SBI from Western Coalfield Limited (Amount:21 lakh)

Can They Accept The Cheque?

Hi Sharda Prasad,

What is the name in your Bank Account? If the name in your bank account is Suraj Chedilal Prajapati they will accept, but if it is Suraj Kumar Prajapati, the banks will not accept the cheque unless the account number of the beneficiary is also mentioned along side the Payee name. Ideally get the cheque in the name that is registered in the Bank account.

do we have to write the bank account number,to which the amount of the cheque is to be transferred, on the back the cheque?..

Hi Aatreya,

It is a good practice to do so eventhough it is not compulsory, you should ideally write your Contact number and the your account number. Since you generally fill the pay-in slip alongwith the cheque while depositing it. However if the cheque is in the dropbox and for some reason the slip and the cheque are separated or the slip is misplaced, the bank will still have the account number written at the back of the cheque. Moreover they can even contact you in any event if there are issues with the cheque if they know your account number. So it is a good practice.

Dear sir

I would like to know from you that why we need draft and moreover how to fill up a draft.please sort out my confusion..

Hi Sai,

I am shortly going to do a post on Drafts and explain everything. Will surely let you know once its ready. It will clear all your doubts.

Dear Sir.

My mother received a cheque of rs 4 lakhs (through Property sharing). A/C Payee cheque

But my mother dont have a SOLE ACCOUNT.

She is only having an EITHER OR SURVIVOR ACCOUNT with me.

Will the bank deposit cash in that account itself or should i have to open a NEW ACCOUNT for my mother.

KINDLY CLARIFY. Expecting your reply

Hi Raghav,

You being the first account holder the bank will accept cheques in your name. You can either have the cheque re-written in your name or open an account in your mother’s name. It will also be wise to ask the bank if they accept the cheque in such a scenario. As such if there is not account of a person then how did the cheque come in here name, since the cheque Payee name will also have to be as per what is in the bank account.

I would like to know whether there is any problem if I write my name with initials along with the signature while it is printed without initials on the cheque.

Hi Dr. Rajani,

Actually it is not required to write your name or initials alongwith the signature on a cheque. The signature and the printed name is good enough.

Hope this solves your query. For any further questions please feel free to ask over here and I will be more than happy to help you out.

plz reply my query

can receiver of cheque or anybody mention the name of payee on blank cheque signed by a issuer.can we file case against 138

Hi Anoop,

Unfortunately, if it is a blank cheque, signed by the genuine issuer, then in that case anyone can write the name and collect the amount. You can try to file a case, but the whole point or risk of a blank cheque that is already signed is just this that anyone can write the name and get he money.

Dear sir,thanks for your valuable tips.

Sir i want to know i have to give check to a financer then what are the things i have to bear in my mind

Hi Krishan,

Thanks for the kind words.

For your query, Write a crossed cheque (a/c payee) cheque as shown in my post. Also write your name and any reference number that you may have obtained from the financer. It will be best adviced to ask the financer if they require anything extra mentioned in the cheque or at the back of the cheque apart from the basic information.

Thank you very much sir.

Since my business is in the U.A.E – DUBAI,

There its different way of writing the amount. For example if i want to write five lakhs, we have to write it as five hundred thousand only.

So, i am confused how to write this in indian

Banking system. Please help me.

Hi,

You will have to write lac or lakh in the cheque. Hope that helped.

thanks for your good work in raising awareness of correct tips on banking.

Keep it up !

Hi Sadhana,

Thanks for the encouragement, such encouraging words from my readers helps me keep going!!!

Hi… my doubt is, is it possible to leave the pay column empty without any name or just write ‘cash’ in the pay column. …

Hi Sijo,

You can leave the Pay column empty, if you want anyone else to be able to write their name and encash the cheque. Aprt from that you cannot write Cash in the pay column, rather if you want to withdraw money using the cheque then you can write Self. This will make the cheque a self cheque and when presented the holder of that cheque can have the amount mentioned in the cheque.

Dear Aniket,

I have received a cheque, my full name is Ananda Kumar Rajanna as per the records in the bank, But in the cheque the name has been mentioned wrongly – Anandha Kumar Rajanna. There is one extra ‘h’ in the name so I asked to him to issue a new cheque, he refused and darkened the letter ‘h’ with ink and put a signature above the name. will this cheque be honored?

Thank you.

Hi Ananda,

Generally the cheque with a signature over a correction works. However off late the banks insist on an error free cheque. You can deposit the cheque with the bank, since he has refused to give a new one. If the bank dishonours the cheque you will have to ask for a new one.

sir if in case some gangsters or theives loot the entire bank,who will be responsible for customers money deposited in the bank

Hi Arjun,

Banks have an insurance and generally not every bank has lockers to loot, and also the amount of cash that is allowed to kept in a branch at a time is limited, so it is unlikely that the entire money that the bank branch has, will be looted. And even in that case, it won’t affect your account balance. At the most the problem can be if you have stuff in your locker and that locker is looted, then in that case locker are insured upto Rs. 1 Lac, so you will be reimbursed upto that limit. If you have a lot of cash or jewellery in the locker, then in that case the bank won’t be able to help you beyond that limit.

Really helpful information. Though it is simple but everyone asks someone else to verify at bank as i notice every time.You depicted each section with pictures. Interesting!!!!

Hi Uddhav,

Thanks a lot for your appreciation!

If I cross the cheque & write A/C Payee in it and also write the Name of the person I am paying to , do I still need to cancel the word ” Bearer ” on the cheque ?

What’s the point of cancelling the word bearer , if its already crossed & the name of the person ( Pay To ) is written ?

Hi Tejas,

The Name of the Person you are paying to is mandatory, so that you have to write in anycase, whether or not your cross the cheque with the words A/C payee or not. If the Words or Bearer are still available, any person holding the cheque can claim it. If you have written A/C payee at the top of the cheque then is a good practice to cross the words or Bearer.

Sir I have a doubt … I want to transfer my money from Sbm to hdfc bank how to write the cheque for that… And both are my accounts only but they are in different city’s .. So how to write can u tell me..

Hi Vishal,

You simply need to write a check from the cheque book of your SBM account in the your name as it appears in HDFC bank. Fill the slip that you have in slip-book and also write your HDFC a/c number at the back of the cheque with contact number and deposit.

thank you sir i got cleared with my doubts

5)sir, during online transactions i had seen that they had asked for only debit card number , expiry date , cvv number so is there a chance for them to note down these details and to withdraw amount even in future even when i do not perform any online transactions so how can i safely do online transactions.

1) sir i took cheque on 29-01-2015 , but the date 24-09-2014 is printed on cheque , so three months validity period counts from 29-01-2015 or 24-09-2014 or is it the date which i write manually in the provided date column counts

2)sir how do the bank validate the signature on the cheque , do they use some equipment or manually , i am asking this because eazily if anyone practice they can forge others signature

3)what are the details that one should give to others if they want to deposit amount into our account , and is there a chance to withdraw an amount by knowing account number and ifsc code

4)because i have heard that some online portals just asks us our account number so can they do online transactions by knowing the account number

5)sir, during online transactions i had seen that they had asked for only debit card number , expiry date , cvv number so is there a chance of withdrawing amount by knowing these details even without pincode so how can i safely do online transactions.

6)in petrol bunks and in some places they ask our card for swiping so while swiping there is a chance of noting down card number , expiry date and cvv number with which they can do online transactions even without pincode because i have observed some online portals do not ask for pincode , so i think its better not to hand over the card to them , so sir what are your views on this

Hi Arjun,

1. The date written on the cheque in the colummn provided at top right is the date from which 3 months are counted. So in your case if the date mentioned on the cheque is 24-9-2014 that was valid only till 24-12-2014 and as of 29-01-2015 it is expired.

2. Banks do it manually by comparing the specimen signature you submit in the form while opening the account. It. It is a manual process and they have experience in identifying certain way of writing and hence are careful with forged signatures.

However forgery does happen and anyone who is good or practices can forge your signature. But they will need your cheque book or blank cheque to do it, since your signature on your cheque from that particular account van only work. So if you are careful of using different signatures for your cheque and different signature for other purposes you should be fine. Also never give out blank cheque or handover your chequebook to anyone. If you need to give a cancelled cheque for ecs or other purpose, strike the entire cheque and write the words canceled on it.

3. To give details to someone for them yo deposit money in your account, you need to give the following:

A. Account holders Name as per bank records

B. Account number

C. Account type like savings or current

D. IFSC code and branch name

4. To withdraw money from your account IFSC code does not work. Also even if they know your ac no. etc they cannot just withdraw cash like that. Banks have otp/passwords etc for every user so the person will need these details. Moreover to withdraw it manually the person will need a self cheque and for that again they will need access to your cheque book and signature so it is not that easy. Incase you want to know how online fraud works you can check the links below …it is difficult and unless you are very careless only then you need to worry.

https://stepupmoney.com/internet-banking-fraud-sim-swap-can-you-be-a-victim/

https://stepupmoney.com/identity-theft-how-to-protect-your-finances-and-avoid-identity-theft/

https://stepupmoney.com/8-internet-banking-mistakes-most-of-us-make/

5 and 6. Yes you need to be careful while handing out your card to anyone for swiping. Always stand there and see when they swipe so that you can be sure that the information is not copied.

Also online transactions ask for cvv and card number with expiry date, but they also ask for either a transaction password/otp/or 3D secure pin to validate transaction so the transaction is devoid of frauds. So mostly all banks have one of the above options before they validate a payment.

Still to be safe go through the above links.

Hope I helped you this time. Thanks!

1.A cheque shall be deemed to have been issued on the date written on the top right column for the requisite purpose and is valid for three months only from that date.

However,a date can be revalidated by the drawer under his full signature.(Only dates on cheques can be revalidated,any other info. filled wrongly will render the cheque useless.Such mistake cannot be validated even with the drawer’s signatures).

2.It depends on bank to bank and at times,branch to branch.However after introduction of cts-2010 cheques,almost all banks have a system that verifies the cheque and account details.

Nevertheless,while issuing cheque books,banks keep a record of the cheques numbers issued,so withdrawing money on cheques with forged signs is almost impossible unless any other person has access to your cheque books and if you have a reasonable doubt,you can issue a stop payment order to the banks with respect to particular cheques or the entire cheque book.

3.If transfee is by cheque,merely your name would suffice.

If it is a case of RTGS,NEFT, you need to provide your name,A/c No.,Branch IFSC and Bank /branch name.

A transfer never requires your personal details like cust. id,dr. card no.,cvv code expiry date etc so be alert in this respect.

4.Its not that easy,specially merely with A/c Nos.

5&6.These are secures with mobile otps and other password validations,so there is less chance of such frauds.

However,be careful to swipe your card on your own and not give access to it to others.

POS terminals do not get confidential information merely by swiping cards.

Be careful while you enter your pin and nobidy sees it.If you are doubtful,change pin immediately.

Hi Nishant,

Thanks for elaborating on the points mentioned above. Appreciated

pleasure’s all mine.

and one more thing with regard to point 2,the drawee bank is liable to the true owner of the cheque if it releases any payments against the A/C of the drawer upon a cheque on which the drawer’s signatures are forged as nothing can validate forgery and no protection is available to the paying banker in forgery cases.

thanks buddy for clearing my doubt,happy to see u helping lot of people like me, it was just great

what are the different ways a cheque can bounce and can we withdraw cash after the date written on cheque and what is the deadline for withdraw of cash from the date written on cheque

thanks

Hi Arjun,

A cheque can generally bounce or be dishonoured for a lot of reasons like the ones given below:

1. Lack of sufficient funds in the bank account of the person issuing the cheque.

2. Signature mismatch.

3. Wrong or outdated cheque, or whose date is passed or a Post Dated Cheque or PDC is deposited before the date mentioned on it.

4. Spelling mistakes in the name of the receiver.

5. Difference in amounts written in words and numbers.

6. Scribbling or overwriting on the cheque.

7. Torn/damaged or illegible cheque.

8. Any other reason that the bank may find not being as per their guidelines or suspicious/forged cheques.

You can withdraw the amount or get the cheque cleared within 3 months from the date of issue of the cheque because the deadline or the duration till which any cheque is valid is 3 months from the date of issue of the cheque or in other words 3 months from the date written on the cheque.

Hope it clears all your doubts. Feel free to let me know if I can help you further.

Hey, it was a very useful blog….thanks a lot :)

Thanks a lot for the kind words and thanks for visiting the site. It is encouraging words like this, that keeps me going.

Hi Aniket,

I have received a cheque from my friend in which the pay column is empty, OR BEARER is not struck off, and he has also written A/C payee only.

So does he need to write my name in the Pay column or should I write myself or should it be kept empty only?

Hi Sourav,

The Pay column needs to be filled, ideally by him. If you know that the cheque is genuinely meant for you and there won’t be any dispute between you or your friend if you write your name on your own, then you can do so. However if the bank finds discrepancies in the ink or writing or something, they may hold the payment or dishonour the cheque completely. So PAY column in anycase needs to be filled and ideally by the person issuing the cheque.

Hi Aniket,

If I want to issue a check from my HDFC account to my friend who has an ICICI account, does my friend (A/C Payee) need to deposit the check at the bank ATM/teller himself or can I do it on his behalf by going to his bank’s ATM/teller and depositing the check for him?

Thanks,

Jimmy

Hi James,

Ideally it should be him who should be doing it. Typically banks allow same bank transfers to be done by anyone. However when there is a change of banks at times banks insist on the account holder to do the needful. However it is observed in lot of cases where Private Banks are more adjusting and allow other bank account holders to transfer cheques to the receivers.

You can visit your nearest ICICI bank and deposit the cheque to your friend’s account. You will need his Account Number, Full name as per bank records, Branch address where he holds the account, IFSC code. With these details they will transfer the cheque to his account. ATM may not allow this, since typically they are programmed for same bank transfers. However certain banks do allow it, but in this case you are better off doing it at a bank branch.

Hope that helped.

Hi Aniket,

Please clarify my doubts in this example – I have two friends with the same name ‘Ajay Sharma’ and they both have HDFC bank accounts, When issuing the check, how do I make sure that the money goes to the right ‘Ajay Sharma’ ?

As the check only shows my bank account number and not the payee’s bank details (just his name), how does the bank transfer the money to the right bank account number?

Thanks,

James

Hi James,

You have to simply write a cheque in the name of Ajay Sharma and issue it to him. Once the cheque is with Ajay Sharma, it is his job to fill-in a Slip with details of his Bank Accounts and drop it the bank. The bank always needs an account number of the person to whom the cheque is written. At times it is also Advised to write the account number at the back of the cheque for the bank to know which name corresponds to which account number. So from your end you only have to issue a cheque to Ajay Sharama, and that concerned Ajay Sharma will have to mention his account number while depositing it to the bank.

Incase you are directly depositing the cheque to Ajay Sharma’s account, then again bank will ask you for the concerned account number. So it is never ever that the cheques are passed merely on the basis of Name of account holders, always a account number is asked.

Hope that clears your doubts.

Hi Aniket,

I agree with your statement that ‘it is the job of correct Ajay sharma to fill in the slip with his bank details’. But I have a question here. If I issue a check to the correct Ajay Sharma and he loses the cheque without his knowledge, and if the cheque is found by a stranger whose name is also Ajay Sharma and he deposits the cheque to his bank account. What will happen here? There will be a dispute between me and the correct Ajay Sharma. While the stranger will be credited the amount. All this happens while the correct Ajay Sharma is unaware that he has lost the cheque and the money is transferred to the stranger. I would have lost my money and my friend Ajay Sharma would not be credited his money. Please explain.

Thank you.

Hi Rohith,

This is an interesting scenario, wherein you have two person with exactly the same name and even when you have crossed the cheque, but since the name is the same of the person who looses as well as finds the cheque, the wrong Ajay Sharma can fill a slip and attach and submit the cheque to his account… this is ofcourse if you haven’t mentioned the correct Ajay Sharma account number and contact info at the back of the cheque, since if it is mentioned, then the new – “wrong” Ajay Sharma won’t be able to change it , since if he tries to tamper with it, the cheque will bounce.

This sort of a scenario is highly unlikely, but yes very much possible, if all the ‘stars’ align and there is real bad luck going. But yeah, in such a situation it will be tricky.

If the correct Ajay Sharma has received the cheque but has lost it, and is not aware of it – Now this is highly unlikely as if he has the cheque, it more likely that he would want to deposit it. It maybe that he is not aware of it then and there, but he will eventually notice a missing cheque – So if you and the correct Ajay Sharma are rational individuals you both will be able to resolve the issue with a realization that he correct Ajay Sharma indeed lost the cheque – So you are not at fault.

Now for the part where what has to be done – Approach the bank and seek details of the transaction. Confront the wrong Ajay Sharma (if the bank is convinced about your narration of the events) and see if the matter can be sorted out mutually.

If not, you can take the legal route and file a police complaint of fraud, since as you said – this wrong Ajay is a ‘stranger’ so it will be established in the investigation that this guy did indeed pocket a cheque which did not belong to him and tried to enchash it.

But again, this scenario is highly unlikely, when A loses a cheque and the person who finds it has the same name…. but anything can happen.

its very helpful and explained in easy language , good job thank u

Glad to have helped. Thanks for the kind words. It is at times like these when all the efforts put in to this blog seem worth it. If you like it do share the site with others so it can help them too. Thank once again for encouraging words.

Thanks for the information sir. Can u please explain what are bank drafts?

Sir my name is Devinder Singh, I have received an A/c payee cheque in my name but there is one extra ‘e’ inserted i.e. Deevinder Singh in my name written on the cheque. Sir my question is whether I will be able to transfer the amount to my bank account or not.

Hi Devinder,

Most likely the cheque will be dishounoured due to the spelling mistake. You will need to get a new cheque from the issuer with a correct name.

THANK YOU VERY MUCH!!!

CLEARED A TON OF DOUBTS

Can you please tell me how to make a cheque for transferring from my account in one bank to my account in another bank? for example tranferring money from my account in ICICI to my account in HSBC

Hi John,

To write a cheque to transfer from your own bank account in one bank to your own account in another you need to simply write a cheque in your own name and deposit in another. For instance write a cheque from your ICICI bank cheque book in your name and deposit the same in HSBC account. Mention the your account number of HSBC bank on the back of the cheque.

Nice, I have a doubt regarding which branch or bank to go in case of transfers? When do we need to go to home branch, can cheque be deposited in any branch? Plus in the above case can’t we deposit the cheque in ICICI itself and they do the transfer.

Thank you in advance.

It is really shocking that from last five years i was writing my cheque very carelessely. Thanx for generating awareness Aniket.

Gr8 Job!! (y)

Glad it helped. Thanks for the encouragement. :)

Hello sir,

Could you please explain me the difference between bearer cheque and order cheque.

I want to order a cheque book from online SBI and I am bit confused between bearer and order cheque..

Hello Raj,

Bearer cheque is simply a usual cheque made payable to anyone but in which the words OR BEARER are NOT struck off. This cheque can be enchashed by the person to whom it is payable or Anyone who gets hold of that cheque. It is risky if lost.

An order cheque on the other hand is a cheque in which the words OR BEARER Are Struck Off and the words OR ORDER are written next to the payee’s. For instance Pay Mr. Raj or Order. This requires the bank to verify the identity of the encasher. Such a cheque can transferred to another person or endorsed to other person by the payee and such endorsement is also verified by the bank before the cheque is encashed.

You can order a usual cheque book. Order or Ac Payee cheque also called crossed cheque is always a safer bet.

Thank Q… For clarifying my doubt..

Helped a lot. Thankyou. (:

Thank u Mr. Aniket. It was very helpful…

Glad to know it helped…. thanks for reading.

thank you sir.

This article is very helpful. You are doing a great work by creating awareness and educating people about their personal finance. Keep it up!! :)

Thanks a lot for the kind words. Much appreciated!

Hi,

I have got a cheque with amount in words written as “50 thousand only” and in figures as 50000/-. It that fine or in words it should be written as fifty thousand.,…

Thanks,

Hi Paritosh!

The cheque wont be approved since words need to be in words itself as fifty thousand and not 50 thousand.

Hope it helps.

Could you please elaborate on writing a self cheque

Hi Kishore!

First of all, thank you for your interest in the site.

Writing a self cheque is actually pretty simple. You just need to write the words SELF in the ‘PAY’ column and DO NOT cross the words Bearer at the end or Write the words A/C Payee on the top of the cheque. Just sign it, put the date and you can encash it at the bank counter. Remember you may need to sign on the reverse of the cheque in front of the bank authority before you can get the cash. This is because SELF cheque is allowed only for the account holder and hence they would verify if you are the account holder and the one who signed the cheque.

Hope it helped. Thanks once again, keep coming back for more.

It is really helpful.

You can add this to the blog in separate section as “Writing Self Cheque”.

Thank you kind Sir. This was most helpful. :)

Hi Gayatri,

Glad it helped… it is a pleasure to know it was useful.

Thanks a lot.

Hello sir,

I have a question, If i write the date manually on the printed cheque. is it acceptable by the bank or the date has also to be printed

can we wright the bank account number with the beneficiary name on the Chq.?

please suggest