The PAN Card procedure is set to be more thorough and strict from 3rd February 2014. What are the changes, and how do changes in the PAN card procedure impact you? Read on.

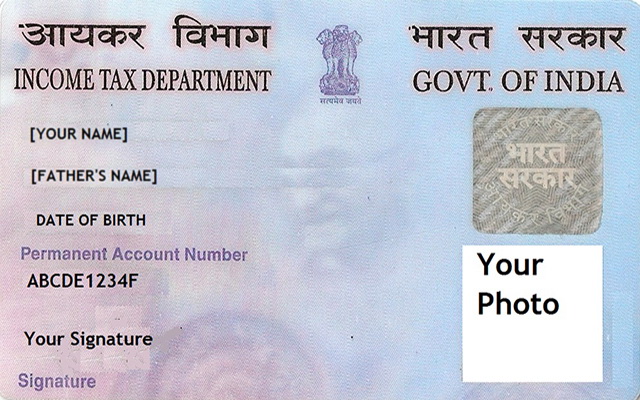

Getting a PAN or Permanent account number which is not only an identity proof, but also mandatory for various financial transactions and Income Tax purposes, is just going to get a little stricter. PAN card procedure is going to change from 3rd February 2014, in order to make the system fool proof and curb the various ways people and businesses look to evade taxes and also to sort out the issue of multiple PAN cards by individuals. While the step is to put a check on misuse of PAN card and prevent any exploitation or loop holes within the system, the common man will find it slightly troublesome to obtain the PAN card in India.

So let us have a look at the changes in the PAN card procedure from 3rd February, 2014.

The documentation pretty much remains the same for the PAN card application; however the changes in PAN card application from 3rd Feb 2014, will mean that the documents will not only need to be self attested, but the applicant needs to physically visit along with the originals of the documents to get them verified at the PAN facilitation centres.

The original documents will be cross checked with the self-attested photocopies and the originals will NOT be retained, but handed over after satisfactory verification. The PAN card application fee will be Rs. 105, inclusive of all taxes. (Rs. 93 as fees + 12.36 % service tax).

The PAN card application form which is Form 49A needs the following documents to be submitted along with it:

POI that is Proof of Identity

POA that is Proof of Address

DOB that is Date of Birth documents

DOB was not required separately earlier as Proof of Identity having the applicant’s date of birth was enough.

What this means is that once you fill up the PAN Card Application Form 49A along with the application fee and the required documents, you will have to make a trip to the PAN Facilitation centre along with the originals of the documents to submit your PAN application. Earlier this wasn’t required and attested copies would suffice. This can be troublesome for a lot of people who are always caught up with their hectic work lives. However, if you consider the fact that it can possibly reduce the fraudulent use of PAN cards and people won’t be issued multiple PAN Cards, then it is probably the step in the right direction from the authorities.

How successful this move will be, only time will tell, but the changes in the PAN Card application from 3rd February 2014, are a step from the Tax authorities to reduce tax evasion that can be achieved by distributing incomes over multiple PAN Cards. On the flip side, the applicants will have to visit the PAN Facilitation centres personally along with original documents. Even if the application is made online, the originals will still need to be verified. So that can take some extra time.

So, what do you think about the changes in the PAN card procedure from 3rd Feb, 2014? Leave your views in the comments section below.

Hello sir, my query is that

My name on 10th TC is “Vikram Dileep Jadhav” and that is wrong and on other documents such as aadhar , election card is “Vikram Dilip Jadhav” which is right. How can i apply for PAN.? There is spelling mistake in documents.. what can i do? Please help sir

Hi Vikram Jadhav,

For a PAN card application you need not give all your ID proof copies. You just one. So submit the one which has the correct spelling and your PAN will be made.